[ad_1]

Oil and gas industries just liked a bumper earnings calendar year, with shareholders seeing report payouts. In its wake, Europe’s Shell and BP each walked back on their formidable minimal-carbon transition plans, with companies throughout the sector rising their investing in new generation.

Which is not very good news for weather improve, largely driven by burning fossil fuels. A person fear is these investments suggest the marketplace and its political allies will struggle tooth and nail for them to prevent “stranded belongings” losses, locking in greater output of weather switching fuels for a long time and even decades to come.

Not only the firms, but also their shareholders could turn, as vested passions, into a broad coalition against eco-friendly energy. At the very least in the U.S. and the U.K., most pensions are invested in capital marketplaces, where by inside of stock markets oil and gas businesses remain amongst the most trusted turbines of dividends and share buybacks. All of this could deter governments from employing all-as well-ambitious climate mitigation policies for fear of leading to fiscal losses to a wide swath of their personal voters.

But centered on a current evaluation, we argue that superior-money governments require not get worried about triggering these money losses. That is since most hits from stranded fossil fuel assets—lower generation volumes or income at lessen selling prices than buyers expected—would fall mainly on the wealthy associates of these countries. That ain’t most voters.

The rationalization is comparatively uncomplicated: these nations all have significant inequality in who owns providers. That implies the rich commonly individual the large bulk of all stocks and bonds, and there is no proof that differs significantly in the oil and gasoline sector.

Governments should in truth fret about prospective consequences on the people of fossil fuels, between vehicle proprietors for illustration, induced by carbon prices and other local climate guidelines that impose penalties on usage, and there have been critical proposals for measures to cut down the unfavorable effects of fossil gas phaseout on the most vulnerable folks in modern society, these as “carbon dividends” and enhanced general public transport. Governments must also be concerned about personnel in the electrical power and other sectors and make certain a just transition for fossil gas communities. Even so, for financial investments, the base 50 p.c and even 90 % of prosperity entrepreneurs could be compensated at incredibly small price tag in contrast to these other steps.

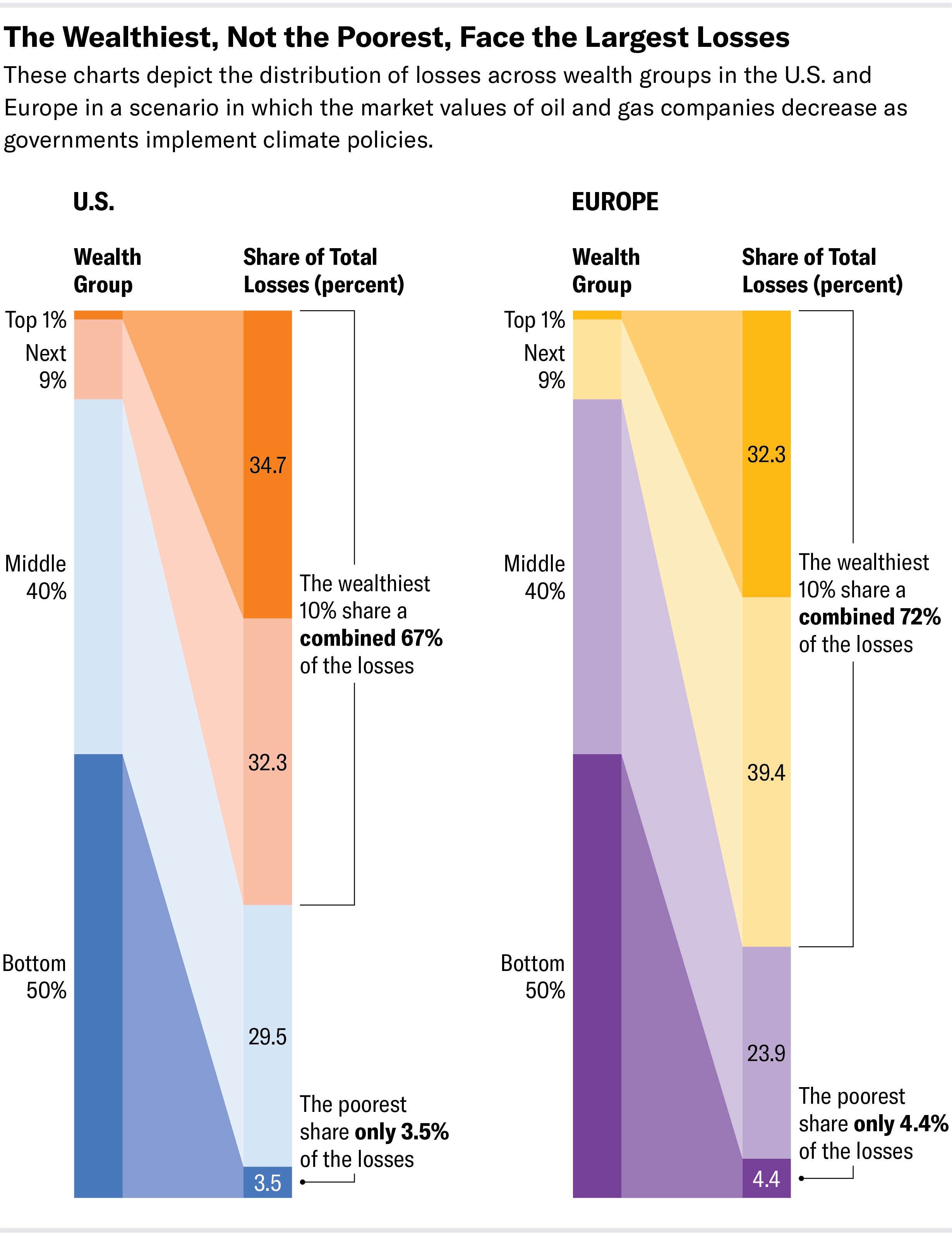

We have beforehand calculated that in a circumstance the place oil and fuel businesses are originally valued based mostly on an expectation of participation in a rising oil and gasoline market, but governments all around the globe apply local climate policies limiting international warming to 2 levels Celsius over preindustrial averages, this could guide to wealth losses of almost $550 billion for U.S. and European shareholders as companies’ market values are readjusted to these decrease anticipations. However, after we assess in which these shareholders are most likely to sit in the wealth distribution, it turns out that only 3.5 per cent in the U.S. and 4.4 p.c in Europe of the losses harm the portfolios of the base 50 p.c of them (see chart). Only set, those people who possess most shares, also have most of the oil and fuel sector shares that get devalued.

For the reason that the major 1 per cent and best 10 percent are so wealthy nonetheless (every U.S. American adult in the prime 1 % owns extra than $13 million in net wealth on normal) these losses, unfold throughout people today, hardly display in their portfolio. We estimate that losses total to much less than 50 percent a p.c of the web prosperity of wealthiest 1 % or 10 percent of People in america, for instance. Moreover, as fossil fuels drop, new financial investment alternatives arise in the rising markets for reduced-carbon choices that allow for for portfolio hedging. Even losses for the the very least rich 50 per cent and 90 per cent are not significant as a proportion of their prosperity. The issue could crop up from the actuality that they have so very little prosperity in the very first spot. Compensating the bottom 50 percent would cost just $12 billion in the U.S. and $9 billion in Europe in a $550 billion decline state of affairs. This could be paid out off with just one particular sixth of the annual profits from a notional $13 for each ton of carbon dioxide emissions price tag in the U.S., which is significantly lessen than present consensus estimates of the social expense of carbon. In Europe, it could also be paid out off with all over 20 % of the earnings from the European Emissions Investing Program (ETS) in 2022.

One could argue that the wealthy are much much more sophisticated investors and will get out of their investments prior to the shares get rid of their benefit, saddling the very poor with substantially much more of the losses. This is certainly a problem, yet our robustness calculations counsel that even if the lousy have been substantially additional most likely to possess oil and fuel shares, compensation expenses would stay limited.

There are several obstructions to going away from fossil fuels, from costs for shoppers and companies to work and which means in communities exactly where fossil gasoline manufacturing is concentrated. Governments have to deal with them all diligently. However, losses for economic investors never rank among the them, and even if they ended up, we show that compensation for any socially suitable losses would be affordable in fact.

Warnings about pension losses and pushback from measures that would bring about asset stranding appear mainly produced in the interest of the incredibly rich, whose ability to take in losses is arguably a great deal larger than absolutely everyone else’s. Losses from unmitigated climate modify, on the other hand, will probably hit the lousy and vulnerable a great deal more durable.

This is an belief and evaluation posting, and the sights expressed by the author or authors are not necessarily those of Scientific American.

[ad_2]

Resource website link